Some Of Clark Wealth Partners

Wiki Article

The Greatest Guide To Clark Wealth Partners

Table of ContentsRumored Buzz on Clark Wealth PartnersGetting The Clark Wealth Partners To WorkThe Single Strategy To Use For Clark Wealth PartnersThe Main Principles Of Clark Wealth Partners Not known Facts About Clark Wealth PartnersClark Wealth Partners for BeginnersThe smart Trick of Clark Wealth Partners That Nobody is Discussing

These are professionals who supply financial investment guidance and are registered with the SEC or their state's safeties regulatory authority. NSSAs can aid senior citizens make decisions regarding their Social Safety advantages. Financial consultants can likewise specialize, such as in trainee loans, senior requirements, taxes, insurance coverage and other facets of your finances. The accreditations needed for these specialties can vary.Not constantly. Fiduciaries are legitimately called for to act in their client's benefits and to maintain their cash and residential property separate from various other assets they manage. Only monetary consultants whose classification requires a fiduciary dutylike licensed monetary organizers, for instancecan claim the very same. This difference likewise means that fiduciary and monetary advisor fee structures vary too.

Some Ideas on Clark Wealth Partners You Need To Know

If they are fee-only, they're much more most likely to be a fiduciary. Several qualifications and classifications require a fiduciary responsibility.

Choosing a fiduciary will guarantee you aren't steered towards certain investments due to the payment they provide - financial company st louis. With great deals of cash on the line, you might want an economic professional that is legitimately bound to use those funds very carefully and just in your ideal passions. Non-fiduciaries might advise financial investment products that are best for their pocketbooks and not your investing goals

The Only Guide for Clark Wealth Partners

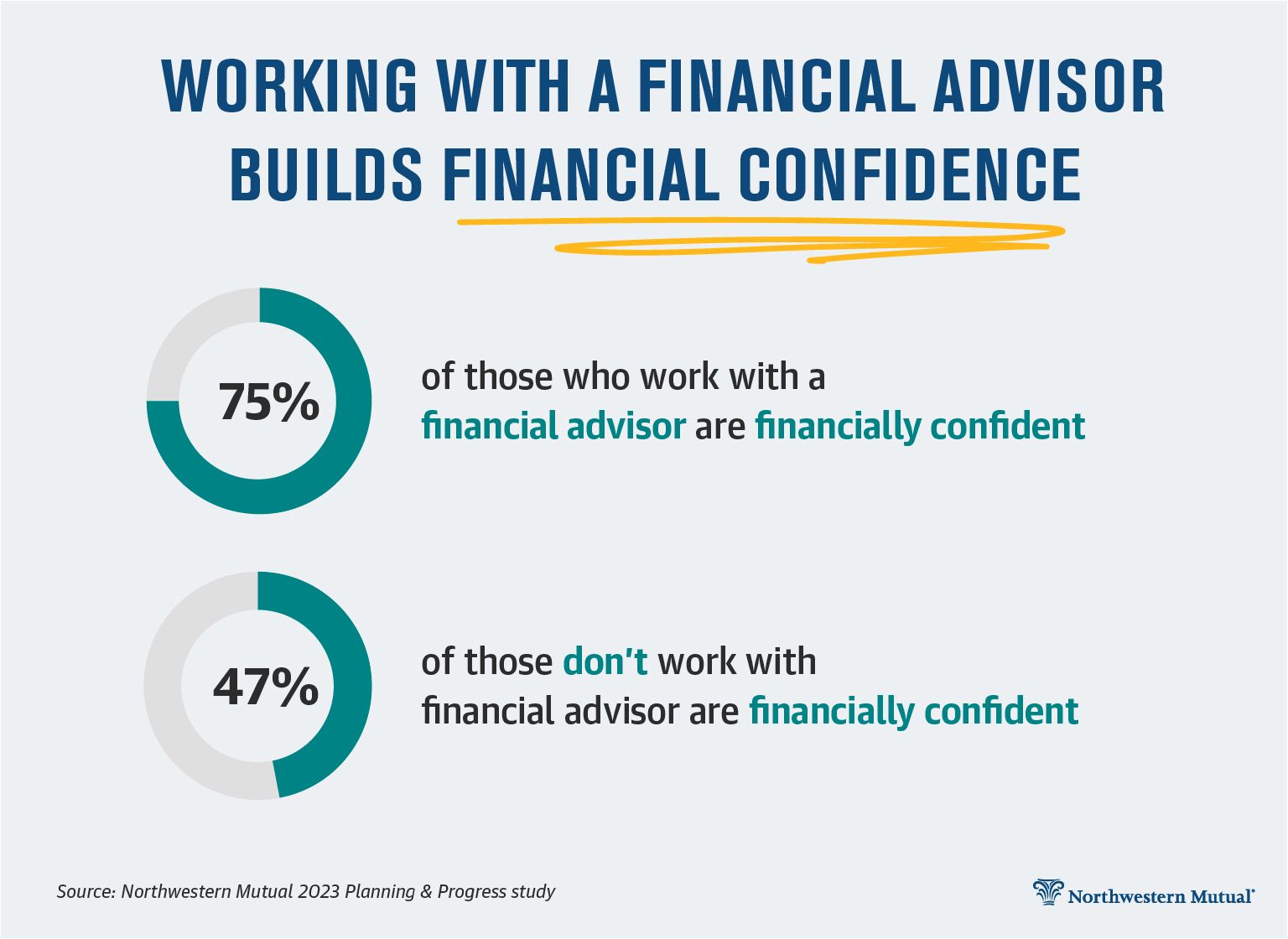

Boost in cost savings the ordinary house saw that functioned with an economic advisor for 15 years or even more compared to a comparable household without an economic expert. "Much more on the Worth of Financial Advisors," CIRANO Task Information 2020rp-04, CIRANO.

Financial recommendations can be beneficial at turning points in your life. When you meet with an advisor for the initial time, work out what you desire to obtain from the recommendations.

Clark Wealth Partners Can Be Fun For Anyone

As soon as you've agreed to go on, your monetary advisor will certainly prepare a monetary plan for you. This is offered to you at another conference in a paper called a Statement of Suggestions (SOA). Ask the consultant to explain anything you don't understand. You ought to constantly really feel comfy with your consultant and their recommendations.Firmly insist that you are alerted of all deals, go to these guys which you get all communication pertaining to the account. Your adviser might suggest a managed discretionary account (MDA) as a way of handling your financial investments. This entails authorizing a contract (MDA agreement) so they can purchase or sell investments without having to examine with you.

6 Easy Facts About Clark Wealth Partners Described

Before you invest in an MDA, compare the benefits to the prices and dangers. To protect your money: Do not give your advisor power of lawyer. Never authorize an empty file. Place a time limitation on any type of authority you give to acquire and sell investments on your part. Insist all communication about your investments are sent out to you, not simply your adviser.This might occur throughout the meeting or digitally. When you go into or restore the ongoing charge plan with your consultant, they should explain how to finish your connection with them. If you're transferring to a brand-new consultant, you'll require to arrange to transfer your financial documents to them. If you need help, ask your advisor to describe the procedure.

To fill their footwear, the country will require more than 100,000 new economic consultants to get in the sector.

Our Clark Wealth Partners PDFs

Assisting individuals achieve their financial goals is a monetary expert's key function. They are also a little service proprietor, and a portion of their time is devoted to handling their branch office. As the leader of their method, Edward Jones economic advisors need the management abilities to hire and handle team, as well as the service acumen to develop and perform an organization technique.Financial consultants invest a long time daily enjoying or reviewing market information on television, online, or in trade magazines. Financial advisors with Edward Jones have the advantage of office research study groups that aid them stay up to date on supply suggestions, mutual fund monitoring, and a lot more. Investing is not a "set it and neglect it" task.

Financial consultants must arrange time weekly to fulfill new individuals and overtake the people in their round. The financial services industry is heavily regulated, and policies transform frequently - https://padlet.com/blancarush65/clark-wealth-partners-eb2eezozlg16amlq. Numerous independent financial experts invest one to two hours a day on conformity tasks. Edward Jones financial consultants are lucky the office does the heavy lifting for them.

Not known Facts About Clark Wealth Partners

Edward Jones financial advisors are encouraged to pursue additional training to broaden their understanding and skills. It's additionally a great concept for financial consultants to participate in market meetings.Report this wiki page